Switching from hobby farm to 'real' farm?

desertmarcy

13 years ago

Related Stories

FARMHOUSESWorld of Design: See How 9 Families Live and Farm on Their Land

Join us as we visit the homes and farms of passionate food producers and hear about rural life around the globe

Full Story

HOUZZ TOURSHouzz Tour: Farm Fresh

Updates bring back the bygone charm of a 19th-century Texas farmhouse, while making it work for a family of 6

Full Story

FARM YOUR YARDMy Houzz: An Urban Farm and Animal Sanctuary in Austin

Four dogs, four chickens, a duck and a kitten find refuge in a photographer’s updated home

Full Story

FARM YOUR YARD4 Farm-Fresh Chicken Coops in Urban Backyards

These Atlanta henhouses are worth crowing about for their charming, practical designs

Full Story

KITCHEN DESIGNThe 100-Square-Foot Kitchen: Farm Style With More Storage and Counters

See how a smart layout, smaller refrigerator and recessed storage maximize this tight space

Full Story

LIGHTINGWhat to Know About Switching to LED Lightbulbs

If you’ve been thinking about changing over to LEDs but aren't sure how to do it and which to buy, this story is for you

Full Story

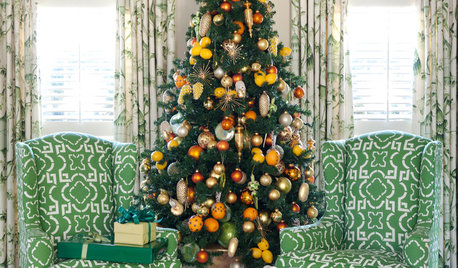

CHRISTMASReal vs. Fake: How to Choose the Right Christmas Tree

Pitting flexibility and ease against cost and the environment can leave anyone flummoxed. This Christmas tree breakdown can help

Full Story

HOUZZ TV FAVORITESHouzz TV: Animals, Love and Color on a Florida Farm

Farm-fresh style is just right for this family of 6 — and their horses, dogs, cats, chickens, zebus, birds and pig

Full Story

KITCHEN DESIGNKitchen of the Week: Resurrecting History on a New York Farm

Built with a 1790 barn frame, this modern-rustic kitchen on a working farm honors the past and makes connections in the present

Full Story

lazy_gardens

Related Professionals

Barrington Hills Landscape Architects & Landscape Designers · Forest City Landscape Architects & Landscape Designers · Wilmington Landscape Contractors · Barrington Landscape Contractors · Longview Landscape Contractors · Tewksbury Landscape Contractors · University City Landscape Contractors · Wells Landscape Contractors · Monroe Fence Contractors · Oak Creek Fence Contractors · Tempe Fence Contractors · Winnetka Fence Contractors · Fresno Decks, Patios & Outdoor Enclosures · Huber Heights Decks, Patios & Outdoor Enclosures · Roanoke Decks, Patios & Outdoor Enclosures